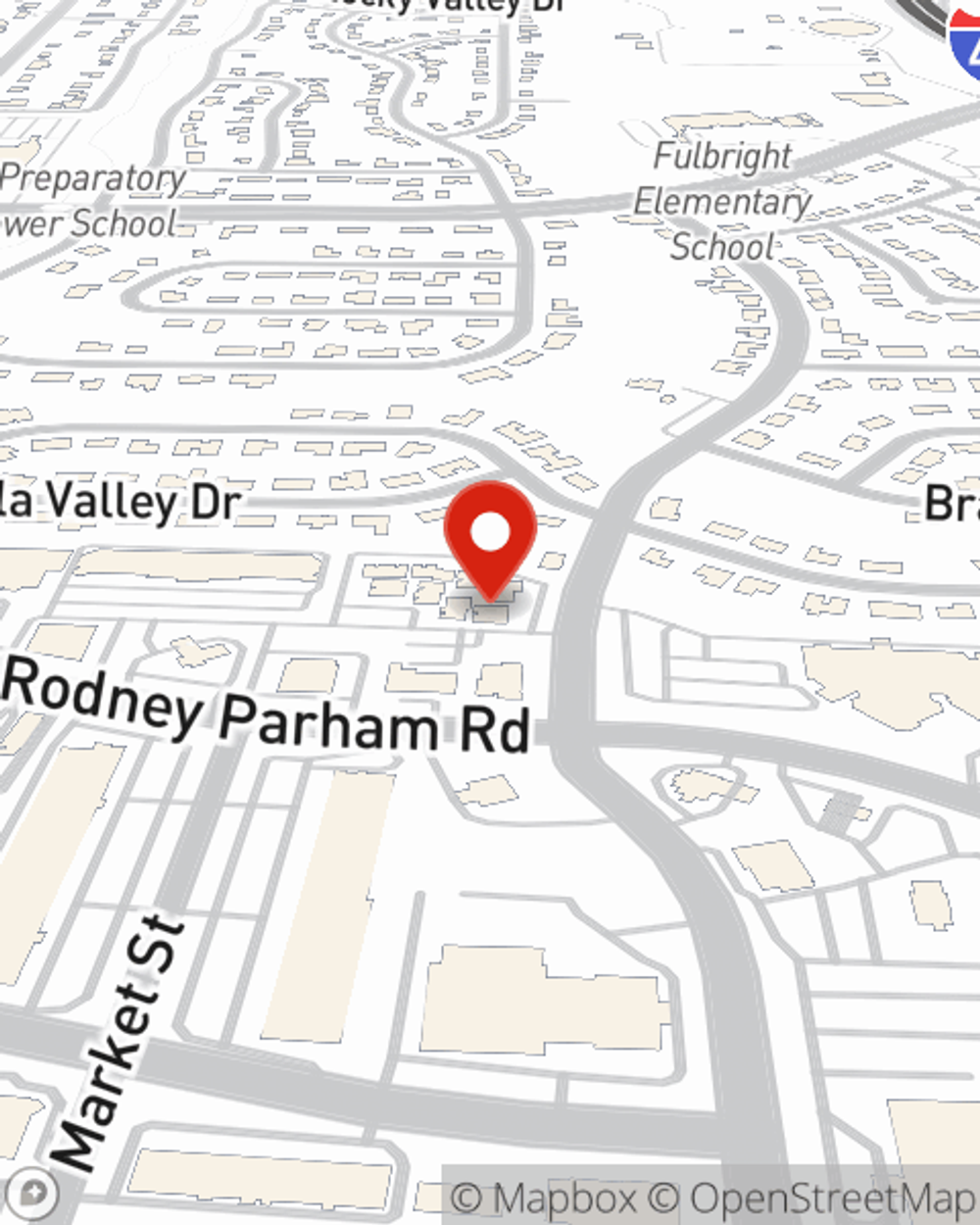

Business Insurance in and around Little Rock

Looking for small business insurance coverage?

Cover all the bases for your small business

Business Insurance At A Great Value!

Running a business can be risky. It's always better to be prepared for the unfortunate catastrophe, like an employee getting injured on your business's property.

Looking for small business insurance coverage?

Cover all the bases for your small business

Surprisingly Great Insurance

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like extra liability or a surety or fidelity bond, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Mike Hart can also help you file your claim.

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Mike Hart today to ask about your business insurance options!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Mike Hart

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.